The $1.6B Valuation Gap: Why the Market is Sleeping on $ADUR

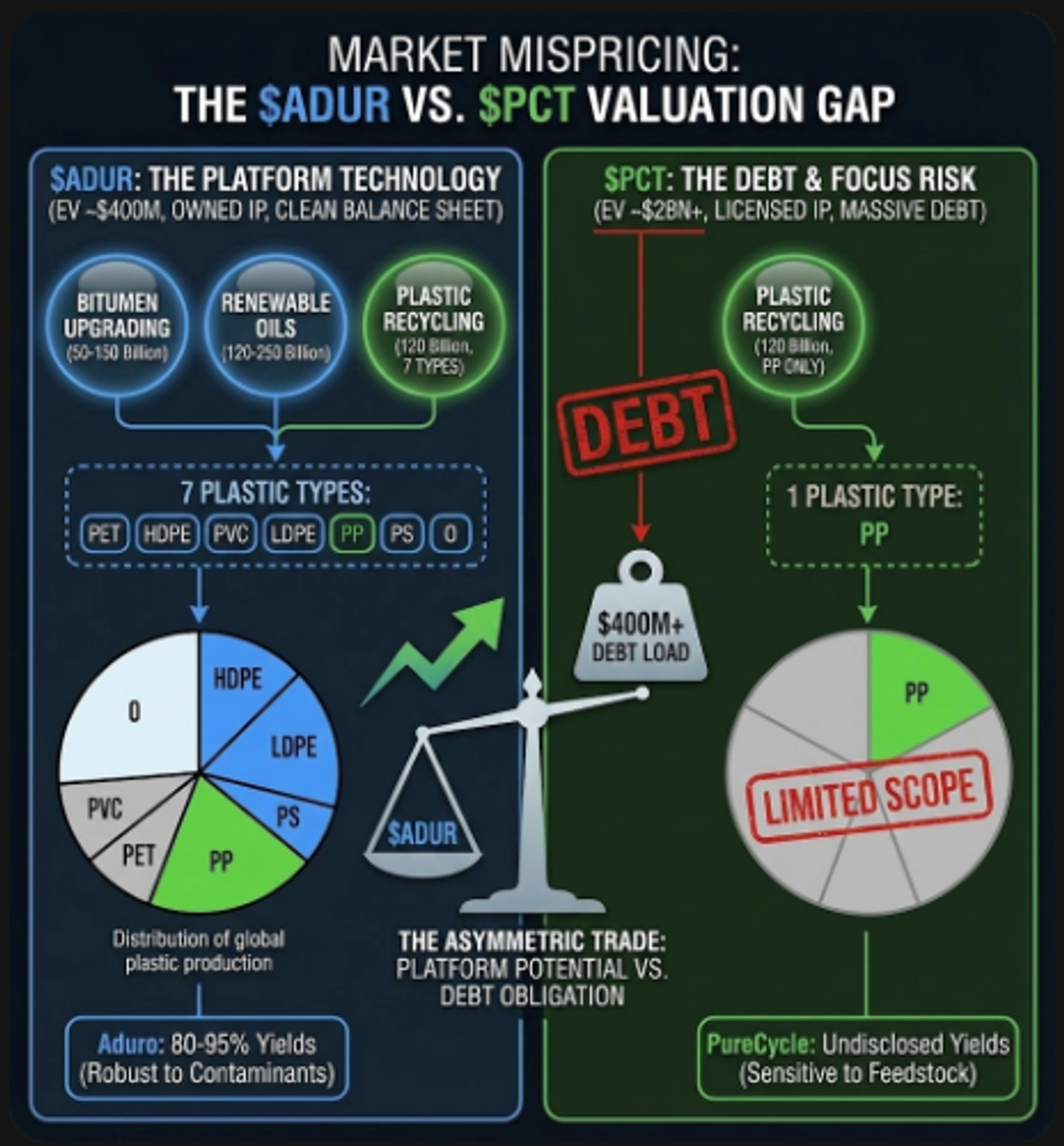

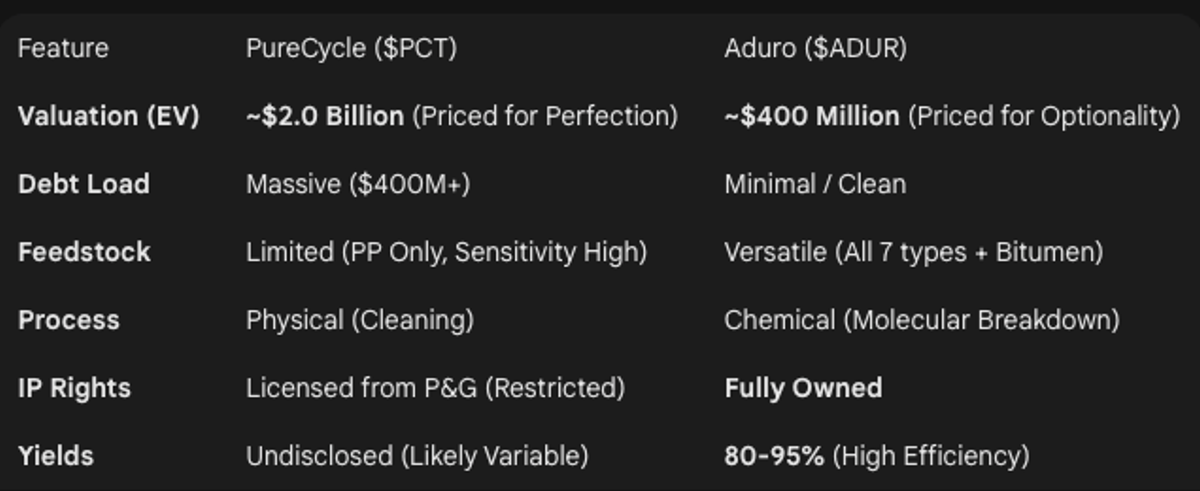

The market is currently making a massive pricing error. It is assigning a $2 Billion+ Enterprise Value (Market Cap + Debt) to PureCycle Technologies ($PCT)—a company burdened by debt and limited by physics—while valuing Aduro Clean Technologies ($ADUR) at a fraction of that, despite Aduro possessing the superior "Platform Technology" and a significantly larger addressable market.

Here is the "Iron Clad" breakdown of why the upside lies with $ADUR, and why the "pushback" regarding PureCycle’s operational plant is actually a red herring.

1. The Balance Sheet Reality: Debt Trap vs. Clean CapThe first thing bears ignore is the capital structure. You aren't just buying a stock; you are buying the business's obligations.

- $PCT (PureCycle): They are swimming in debt. To maintain their current valuation, they must execute perfectly at Ironton. They have over $400M in debt . When you factor in their cash burn to keep the lights on and fix technical issues, their "Enterprise Value" is bloated. The market is pricing them as if success is guaranteed.

- $ADUR (Aduro): Clean balance sheet. Minimal debt. Cash on hand. When you buy $ADUR, you are buying pure equity upside, not a debt-service obligation. The $400M valuation is a floor for a technology that addresses three multi-billion dollar verticals, not just one.

2. The Technology Moat: "One-Trick Pony" vs. The "Everything Store" This is the most critical technical distinction that the market misses. PureCycle ($PCT) = Physical Recycling (Solvent-Based)PureCycle is a "physical" recycler. They use a solvent to wash Polypropylene (PP).

The Flaw: They don't change the molecular structure. They just "clean" it. This means they are extremely sensitive to feedstock quality. If the waste plastic is too dirty or has the wrong contaminants, their process struggles or fails. They are fighting physics.

The Limit: They can only do Polypropylene (PP). Look at the pie chart in your diagram. PP is just one slice of the global plastic waste pie.

Aduro ($ADUR) = Chemical Recycling (Hydrochemolytic™) Aduro uses a chemical platform (HCT) that utilizes water to sever the bonds of the plastic chains.

The Advantage: It handles the "dirty" stuff. It doesn't just wash the plastic; it breaks it down and rebuilds it. It is robust against contaminants that would clog PureCycle’s filters.

The Scope: As your diagram clearly shows, Aduro targets 7 Plastic Types (PET, HDPE, PVC, LDPE, PP, PS, and "Other"). PCT Addressable Market: ~120 Billion (Optimistic, PP only). ADUR Addressable Market: ~120 Billion (Plastics) + 120-250 Billion (Renewables) + 50-150 Billion (Bitumen).

- The "Plant" Argument Rebutted: Bears say, "But PureCycle has a plant!"

- Reality: Having a plant that struggles to reach nameplate capacity due to seal failures and feedstock sensitivity is not an asset—it's a liability.

The "Undisclosed Yields" noted in your diagram are a massive red flag. If the yields were 95%, they would be shouting it from the rooftops. Their silence speaks volumes.

3. Intellectual Property: Renters vs. OwnersThis point is often buried in SEC filings, but it is lethal to the $PCT long-term thesis.

$PCT (The Renter): PureCycle licenses its technology from Procter & Gamble (P&G). They are, in effect, a franchisee of P&G's IP. They have "grant-back" clauses where improvements they make often have to be licensed back. They do not fully control their own destiny.

$ADUR (The Owner)Aduro owns its IP. The Hydrochemolytic™ Technology (HCT) is their own invention. They have a growing patent portfolio that they control 100%. When you own the IP, you can license it out globally (high margin, zero capex). When you rent the IP (like PCT), you are forever paying the landlord.

4. The Hidden Catalyst: Bitumen UpgradingYour diagram highlights a massive blue box: Bitumen Upgrading ($50-150 Billion).

$PCT has zero exposure to this.

$ADUR’s technology works on heavy oil/bitumen just as well as it works on plastics. This is the "sleeper" value. Canada (Aduro’s home) is the land of bitumen. If Aduro signs one partnership to upgrade bitumen using HCT (which is cleaner and more efficient than current methods), that vertical alone justifies a valuation higher than their current market cap. The plastics recycling is the headline; the bitumen is the retirement fund.

5. Summary: The Asymmetric TradeThe "Pushback" against Aduro is that they are "early." But in deep-tech investing, "early" with a proven platform is where the 10x returns are made.

Conclusion: If the market is willing to assign $2 Billion to a single-plastic, debt-heavy, licensed-tech company like PureCycle, then Aduro, with its multi-vertical platform, owned IP, and ability to handle the "dirty" feedstock PCT can't touch, is fundamentally mispriced.The "Plant" isn't the moat. The Chemistry is the moat. And Aduro owns the chemistry.

Disclosure and Disclaimer. This article reflects my personal research and opinions and is provided for informational purposes only. It is not financial advice, a recommendation to buy or sell any security, or a consideration of your individual circumstances. Investing in small-cap and pre-commercialization companies involves significant risk, including the risk of total loss. Always do your own research and consider speaking with a qualified financial professional before making investment decisions. I am long $ADUR

This article reflects personal research and opinions and is provided for informational purposes only. It is not financial advice, a recommendation to buy or sell any security, or a consideration of your individual circumstances. Investing in small-cap and pre-commercialization companies involves significant risk, including the risk of total loss. Always do your own research and consider speaking with a qualified financial professional before making investment decisions.

Stay Informed with The Wire

Get the latest insights and analysis on public companies delivered directly to your inbox.